When it comes to managing B2B payments in the travel industry, it is important to consider the complexity of the travel ecosystem. This web of businesses, which includes airlines, online travel agents (OTAs), and corporate travel management companies (TMCs), all rely on each other to function, each with unique roles to play. Each business in the ecosystem has different payment processes to manage, adding another layer of complexity to B2B payments in travel.

As the travel industry continues to recover, OTAs must prioritise their B2B travel payments and consider how the right payment strategy can protect their bottom line. New technology is a key factor in successfully managing payments, offering benefits such as improving cash flow, optimising cross-border transactions, streamlining administration, and reducing costs. By understanding the key considerations for B2B payments in travel and leveraging technology to support payments, online travel agents can position themselves for success in a competitive market.

1. The importance of secure payments in travel B2B transactions

As the travel industry continues to evolve and become more digitally-focused, secure payments are a critical consideration for B2B transactions. With the rise of online booking and payment systems, travel businesses must take steps to ensure that their payment processes are secure to protect themselves and their customers from fraud and financial loss.

The consequences of insecure payment processes in travel B2B transactions can be severe. Not only can businesses lose money, but their reputation can also be damaged, resulting in a loss of trust from both customers and partners. Additionally, financial losses can lead to operational challenges, hindering the growth and success of the business.

One of the best ways for travel businesses to ensure secure payments is to implement secure payment technologies and processes. These can include encryption, tokenisation, and two-factor authentication. In addition to implementing secure payment technologies and processes, travel businesses must also stay up-to-date on security standards and regulations, such as the Payment Card Industry Data Security Standard (PCI DSS). Compliance with these standards can help businesses avoid costly fines and maintain customer trust.

By implementing secure payment technologies and staying up-to-date on security standards, travel businesses can protect themselves, their customers, and their reputation, setting themselves up for success in the ever-evolving travel industry.

2. Choosing the right payment method for your travel business

Choosing the right payment method is a crucial consideration for managing B2B payments in the travel industry. With so many payment options available, it can be challenging to determine which one is the best fit for your business. Factors such as transaction volume, currency exchange rates, and payment processing times can all impact the decision-making process.

The most traditional payment option is bank transfers. While bank transfers can be slower than credit cards, they offer lower transaction fees and are a popular payment method for international transactions. Bank transfers are also more secure than credit cards, as they require the recipient's bank details to initiate the payment.

Virtual commercial cards (VCCs) are a newer payment method that has gained popularity in the travel industry. These cards are generated for each transaction and have a limited spending amount, adding an extra layer of security. VCCs can also simplify payment reconciliation by automatically categorising transactions and linking them to specific bookings.

By evaluating these factors and weighing the pros and cons of each payment method, travel businesses can choose the payment method that best meets their needs and supports their growth and success in the competitive travel industry.

3. Minimising risk and fraud in travel B2B payments

Minimising risk and fraud is a crucial consideration for managing B2B payments in the travel industry. With the large volume of transactions and the complexity of the travel ecosystem, travel businesses must take steps to protect themselves from potential losses due to fraud or other risks.

One effective way to minimise risk and fraud is to implement secure payment technologies such as encryption, tokenisation, and two-factor authentication. These technologies can help protect payment data and prevent unauthorised access to sensitive information. Travel businesses can also consider working with service providers that supports fraud prevention tools such as fraud monitoring, chargeback protection, and real-time fraud detection.

Another way to minimise risk and fraud is to establish clear payment policies and procedures. These policies should include guidelines for verifying the identity of customers and suppliers, as well as procedures for reporting and addressing suspicious transactions. Travel businesses can also conduct regular training and education sessions for their employees to help them identify and respond to potential fraud or risks.

In addition, travel businesses can reduce risk and fraud by implementing a system of checks and balances. This can involve segregating duties among different employees, such as separating payment processing from payment approval, to reduce the risk of fraud or error. Travel businesses can also establish a system for reviewing and reconciling payments to ensure accuracy and detect any potential issues.

Finally, travel businesses can also consider working with reputable partners and suppliers to minimise risk and fraud. This can involve conducting due diligence on potential partners and suppliers, verifying their identity and credentials, and regularly monitoring their payment and transaction activities.

4. Navigating currency exchange rates for travel b2b payments

Navigating currency exchange rates is a critical consideration for managing B2B payments in the travel industry. As travel businesses engage in international transactions, they must navigate fluctuating exchange rates to ensure that they are getting the best value for their money.

One option for managing currency exchange rates is to use a multi-currency account. This account allows travel businesses to hold and manage multiple currencies in a single account, providing flexibility and convenience. With a multi-currency account, travel businesses can avoid the need for frequent currency conversions, reducing the risk of exchange rate fluctuations and associated fees.

Another option for managing currency exchange rates is to use a payment service provider (PSP). PSPs offer services that allow businesses to exchange currencies at competitive rates, often with lower fees than banks. With the appropriate and relevant licenses, PSPs can also provide guidance and advice on currency fluctuations and help businesses develop strategies for managing currency risk.

Finally, travel businesses can also consider using payment platforms that support multiple currencies and provide real-time currency conversion. These platforms can automatically convert payments into the recipient's currency, simplifying the payment process and reducing the risk of currency fluctuations.

5. The benefits of using (our virtual) commercial cards (VCCs) in travel

VCCs have become an increasingly popular payment method in the travel industry, offering numerous benefits for both buyers and suppliers, other than just better rebates and ease of withdrawal.

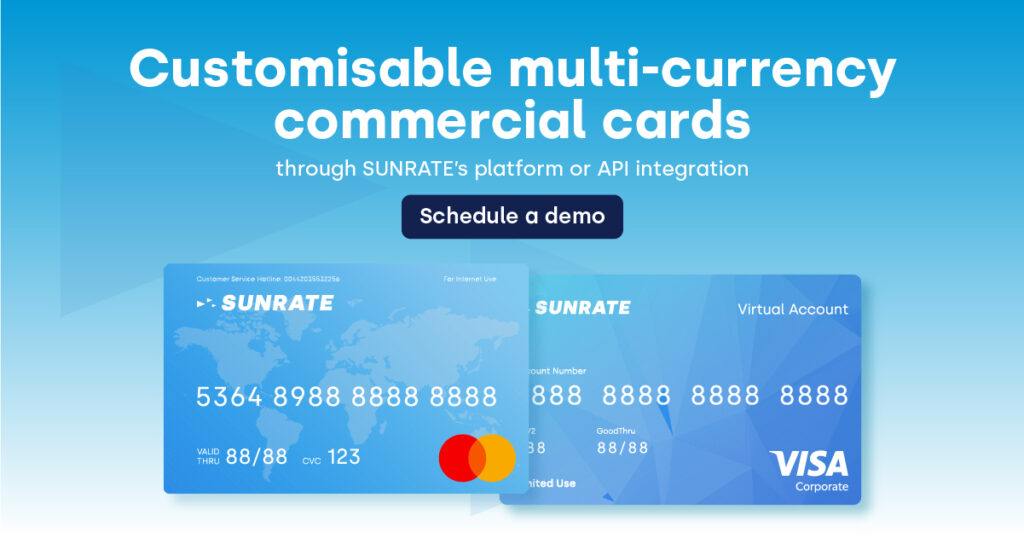

SUNRATE commercial cards

With SUNRATE's online solutions, our (virtual) commercial cards have proven their ability to innovate and provide peace of mind while processing travel payments:

It is also important to note that SUNRATE is certified to the international financial data security standard: Payment Card Industry Data Security Standard (PCI DSS) Level 1.

SUNRATE is an intelligent global payment and treasury management platform for businesses worldwide. Since its inception in 2016, SUNRATE is recognised as a leading solution provider and has enabled companies to operate and scale both locally and globally in 150+ countries and regions with its cutting-edge proprietary platform, extensive global network, and robust APIs.

With its global headquarters in Singapore and offices in Hong Kong, Jakarta, London and Shanghai, SUNRATE partners with the top global financial institutions, such as Citibank, Standard Chartered, Barclays and is the principal member of both Mastercard and Visa.

Find out more about how SUNRATE can revolutionise travel payments for you today.

Share to

By clicking Subscribe, you have read and agreed to our《《Privacy and Terms》》

Commercial cards are reshaping the B2B payment landscape, presenting businesses with an exciting opportunity to embrace innovation and drive their financial processes to new heights.

Effortlessly and economically settle payments to your Chinese suppliers. When it comes to making international payments, businesses seek swiftness, simplicity, and affordability. This is especially crucial for transactions involving China, as businesses frequently encounter various obstacles like rigorous declaration procedures, currency restrictions, regulatory compliance, foreign exchange uncertainties, exorbitant fees, and language barriers during administrative […]

In recent decades, China has emerged as a global economic powerhouse, reshaping the dynamics of international trade and becoming a driving force behind the success of numerous businesses worldwide. Even though it is still considered as an emerging market, the sheer scale and potential of China’s market have drawn the attention of entrepreneurs and corporations […]

We hope to use cookies to better understand your use of this website. This will help improve your future experience of accessing this website. For detailed information on the use of cookies and how to revoke or manage your consent, please refer to our < privacy policy >. If you click the confirmation button on the right, you will be deemed to have agreed to use cookies.